change in net working capital dcf

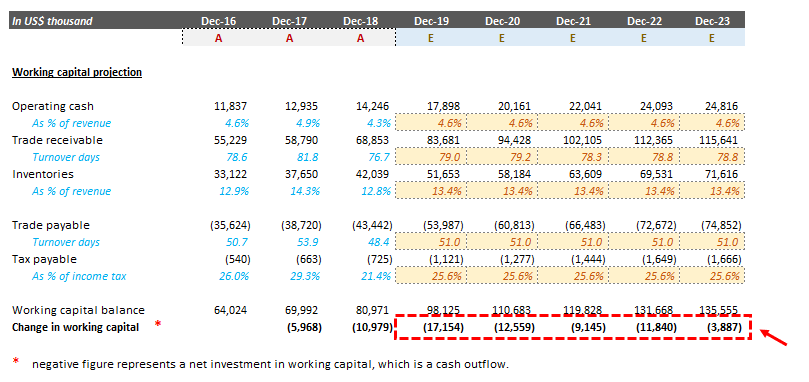

Working capital changes can make cash flows lumpy and simply putting last years or the trailing twelve month free cash flow number into a DCF model could produce wild swings. In the DCF method change in working capital would exclude change in cash cash equivalents and current financial debt and include non financial items such as change in inventories receivables payables.

Change In Net Working Capital Nwc Formula And Calculator

It means that the company has spent money to purchase those assets.

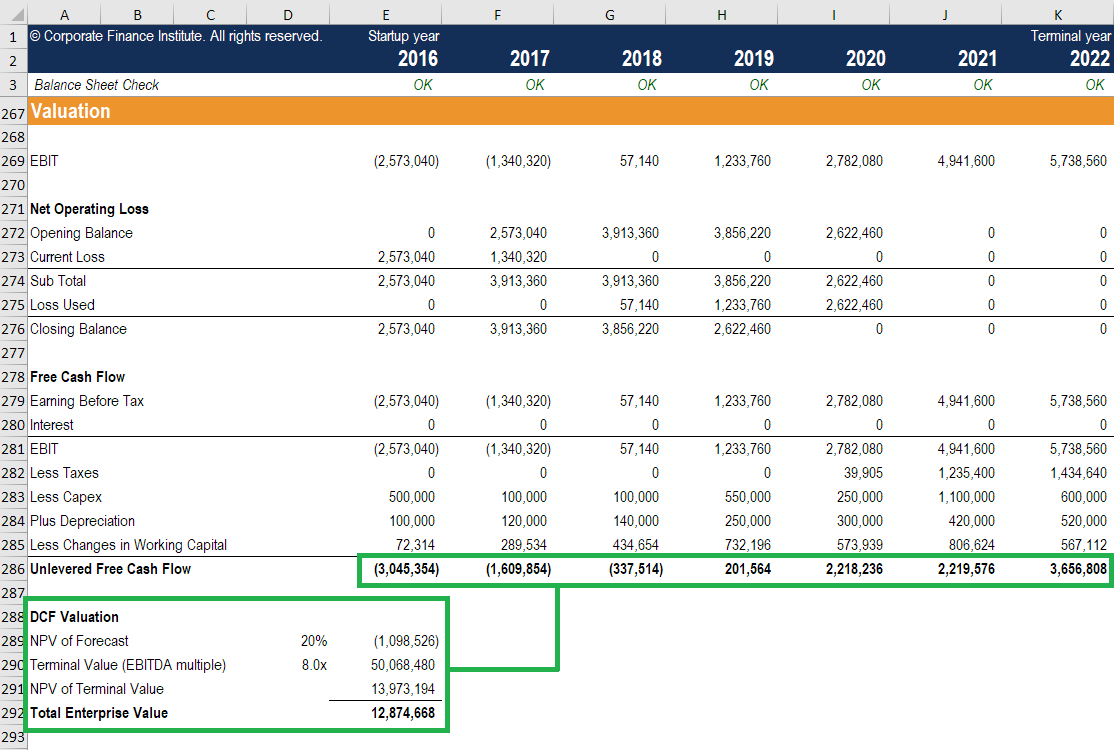

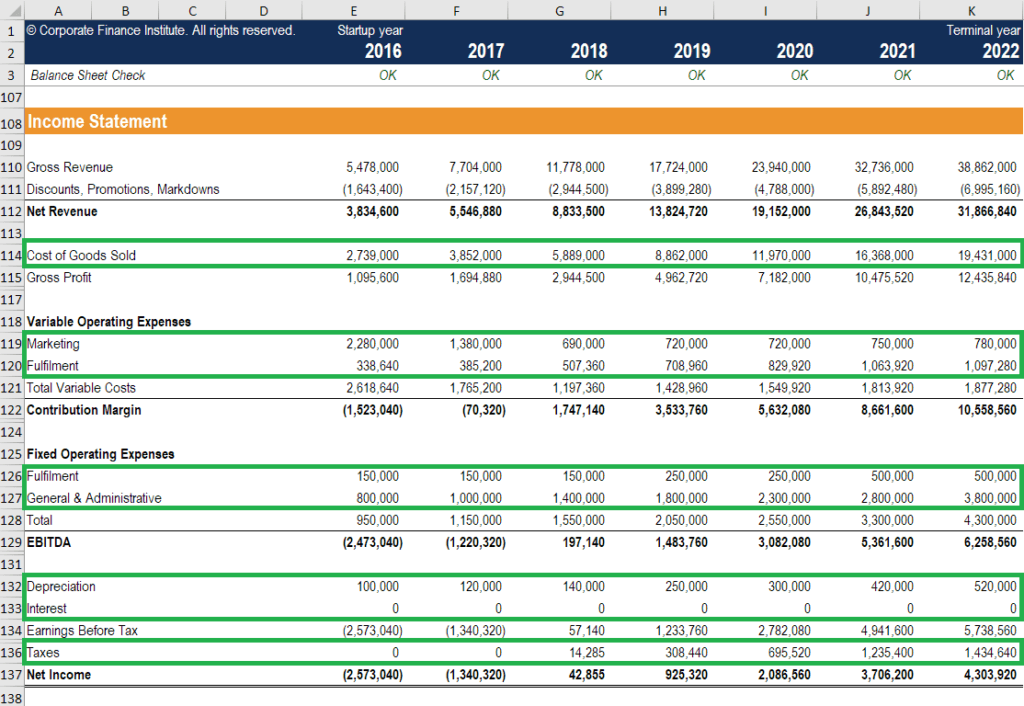

. File with a little more detail. Note that we have also calculated the change in net working capital since this figure will be used later in cash flow calculations. This article was.

At the core working capital changes are analyzed and projected to ensure changes in cash are correctly forecast. DCF Series Part 1Introduction Change in Net Working Capital Posted on July 9 2018 July 26 2018 by Ke Xuan Disclaimer. Change in the net working capital is the change in net working capital of the company from the one accounting period when compared with the other accounting period which is calculated to make sure that the sufficient working capital is maintained by the company in every accounting period so that there should not be any.

Therefore Microsofts TTM owner earnings come out to be. There would be no change in working capital but operating cash flow would decrease by 3 billion. You are right DA and capital expenditures will zero out or capex will be slightly higher than depreciation.

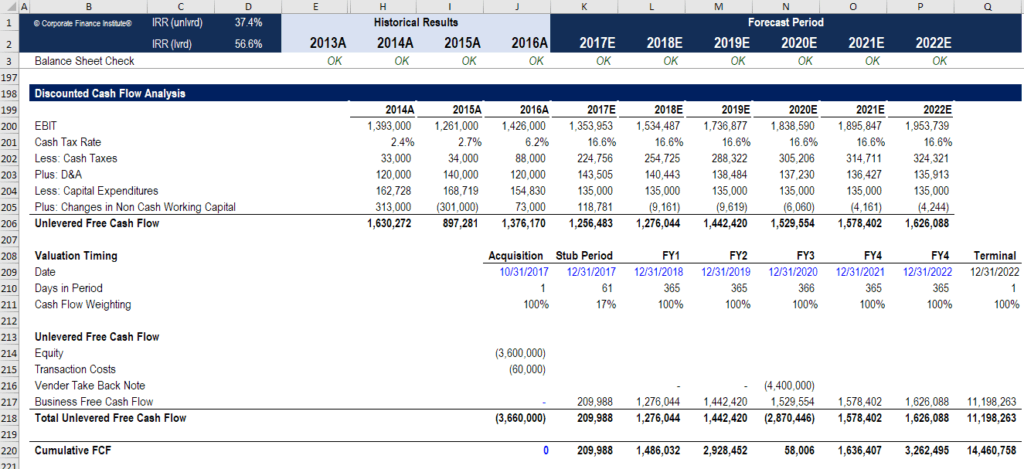

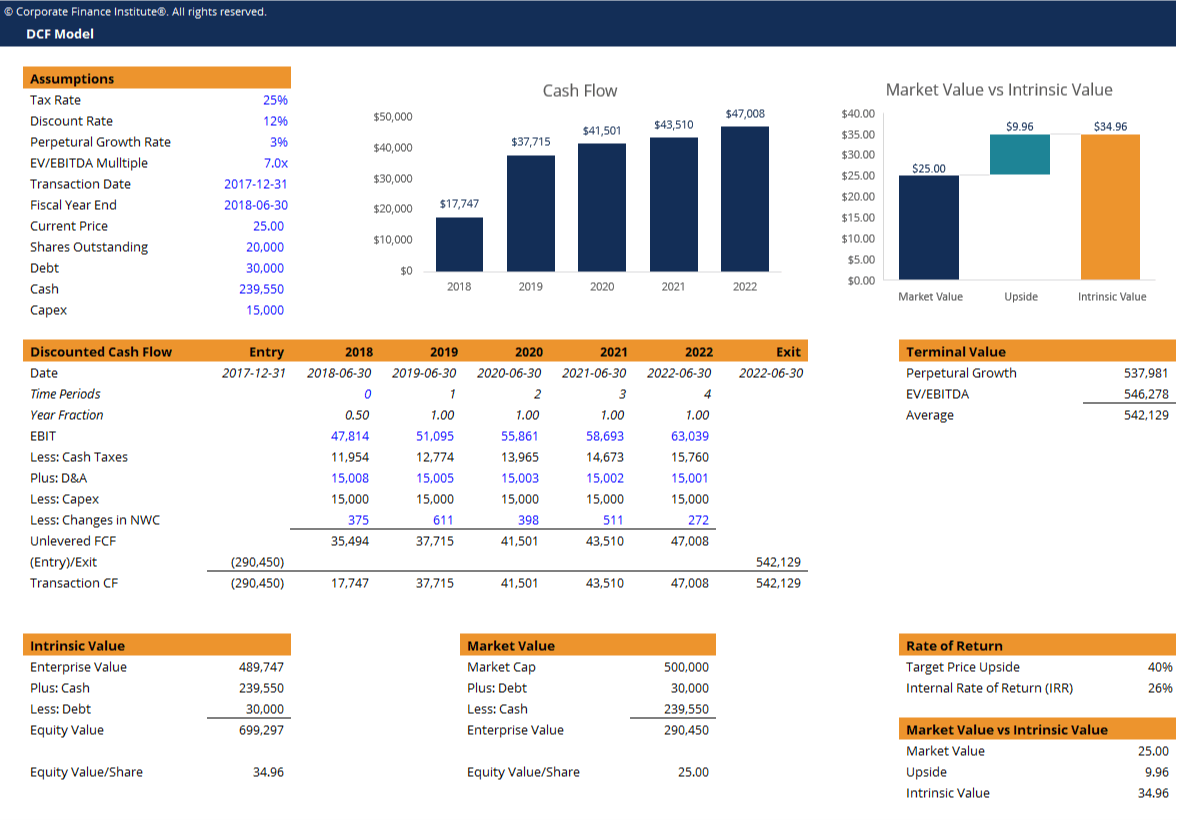

When you use the lower number for changes in working capital and then compute the net present value the result is consistent with the true theoretical number. Because the change in working capital is positive it should increase FCF because it means working capital has decreased and that delays the use of cash. DCF analysis comparable companies and precedent transactions.

A negative change in working capital working capital forecast to decrease is also possible in certain businesses and at certain times such as when a business is experiencing a downturn in its markets. One is to use the change in non-cash working capital from the year 307 million and to grow that change at the same rate as earnings are expected to grow in the future. Changes in working capital.

So current assets have increased. The DCF calculation would give you Enterprise Value to which you would then in order to get Equity value. Since the change in net working capital has increased it means that change in current assets is more than a change in current liabilities.

How do you project changes in net working capital NWC when building your DCF and calculating free cash flow. When changes in working capital is positive the company is either selling off current assets or else raising its current liabilities. Merely because a company produces a net profit of 100000 does not mean the company has 100000 in cash available to.

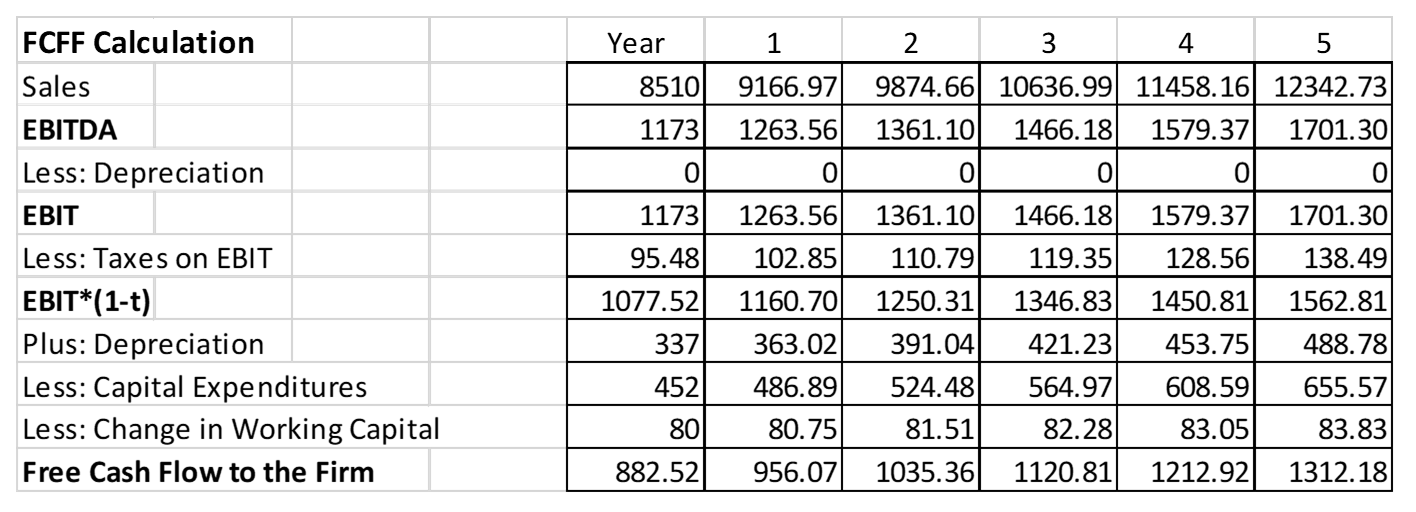

The changes in working capital are discounted using the WCSales ratio working capital over sales which in this case is 80 8510 094. 18819105991263-13102 19192 34245. Once we have forecasted these working capital items we link our balance sheet directly to these cells.

What are Changes in Net Working Capital. The implications of this assumption in a long-term forecast must be carefully analyzed. Part II of this blog identifies methods often used by business appraisers when forecasting working capital.

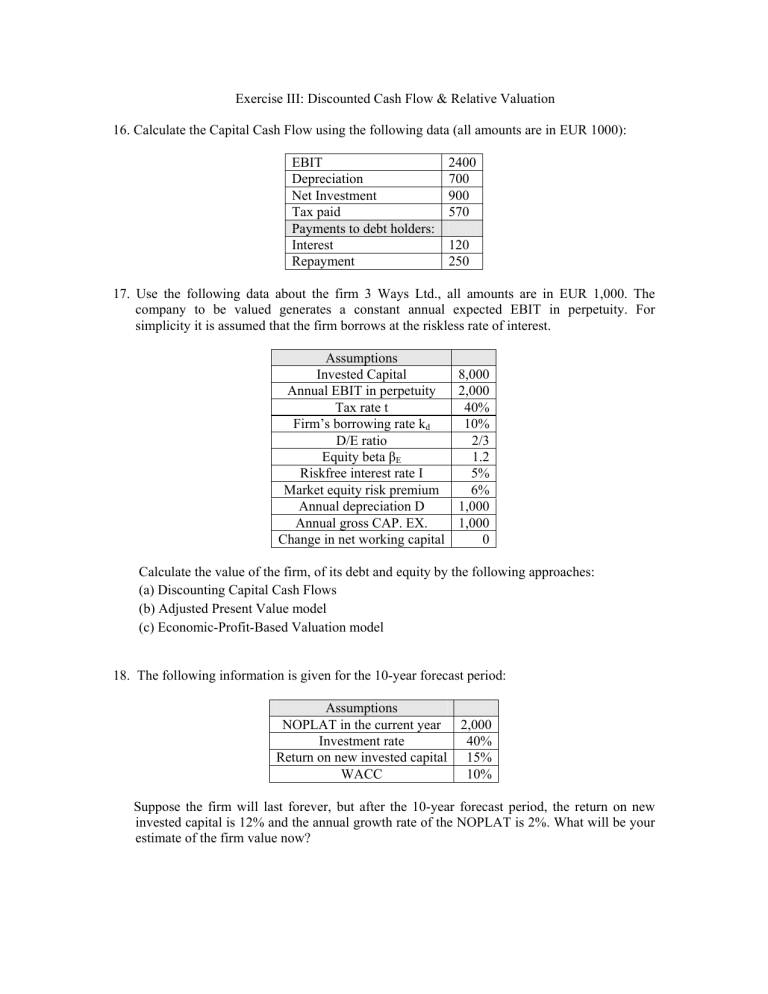

As I am a novice in valuation techniques this series serves to outline my thought process and approach towards calculating the intrinsic value of. Understanding the impact of changes in net working capital is extremely important in financial modeling and corporate valuation Valuation Methods When valuing a company as a going concern there are three main valuation methods used. Change in Net Working Capital 12000 7000.

Since the change in working capital is positive you add it back to Free Cash Flow. You will still need additions to net working capital in the terminal year so it should be included or removed in the calculation of cash flow in the terminal year. This is probably the least desirable option because changes in non-cash working capital from year to year are extremely volatile and last years change may in fact be an outlier.

Then you discount the FCFF to its present value using the WACC. In this video I cover the different ratios tha. Besides you can refer to technical articles published on our website to have a better picture of what Investment Banking recruiters tend to ask and the range of technical knowledge an interview can cover in an interview.

If the change in NWC is positive the company collects and holds onto cash earlier. The Change in Net Working Capital NWC section of the cash flow statement tracks the net change in operating assets and operating liabilities across a specified period. Be sure to include depreciation in the operating income calculaton though.

In this case the change in working capital is computed using the formula above and it is dramatically less. The screenshots below illustrate the same type of analysis for working capital. Working capital refers to the assets and liabilities that you need in running the business other than the fixed assets which are subject to depreciationamortization some common items are operating cash account receivables and payables etc.

Change in Net Working Capital 5000. Net Working Capital and Change in Net Working Capital are easy metrics that require you to learn by heart and grasp the meanings behind these metrics. The Change in Working Capital gives you an idea of how much a companys cash flow will differ from its Net Income ie after-tax profits and companies with more power to collect cash quickly from customers and delay payments to suppliers tend to have more positive Change in Working Capital figures.

FCF EBIT1-Tax Rate Depreciation and Amortization Capital Expenditures Increases in Net Working Capital NWC If you have an increase in net working capital you have more current assets than liabilities than you did in the previous period. Very often when your business is growing you will need more inventory and. Changes in working capital simply shows the net affect on cash flows of this adding and subtracting from current assets and current liabilities.

Dcf Model Tutorial With Free Excel Business Valuation Net

Explaining The Dcf Valuation Model With A Simple Example

Dcf Analysis Pros Cons Most Important Tradeoffs In Dcf Models

Change In Working Capital Video Tutorial W Excel Download

Normalised Cash Flow In Dcf Working Capital Taxes And Stable Roic Edward Bodmer Project And Corporate Finance

Discounted Cash Flow Create Dcf Valuation Model 7 Steps

Discounted Cash Flow Model Street Of Walls

Exercises On Discounted Cash Flow Valuation I

Dcf Model Tutorial With Free Excel Business Valuation Net

Projecting Net Working Capital For Free Cash Flow Calculation Dcf Model Insights Youtube

Change In Working Capital Video Tutorial W Excel Download

Dcf Model Training The Ultimate Free Guide To Dcf Models

Dcf Model Training The Ultimate Free Guide To Dcf Models

Discounted Cash Flow Analysis Veristrat Llc What S Your Valuation

Free Cash Flow Fcf Most Important Metric In Finance Valuation

Step By Step Guide On Discounted Cash Flow Valuation Model Fair Value Academy

Change In Net Working Capital Nwc Formula And Calculator

Normalised Cash Flow In Dcf Working Capital Taxes And Stable Roic Edward Bodmer Project And Corporate Finance